exit lng

What is LNG ?

Liquefied natural gas (LNG) is a fossil gas made primarily of methane that has been cooled and condensed into a liquid form. This makes it easier to transport, especially by ship over long distances, as it takes up about 600 times less space than its gas form.

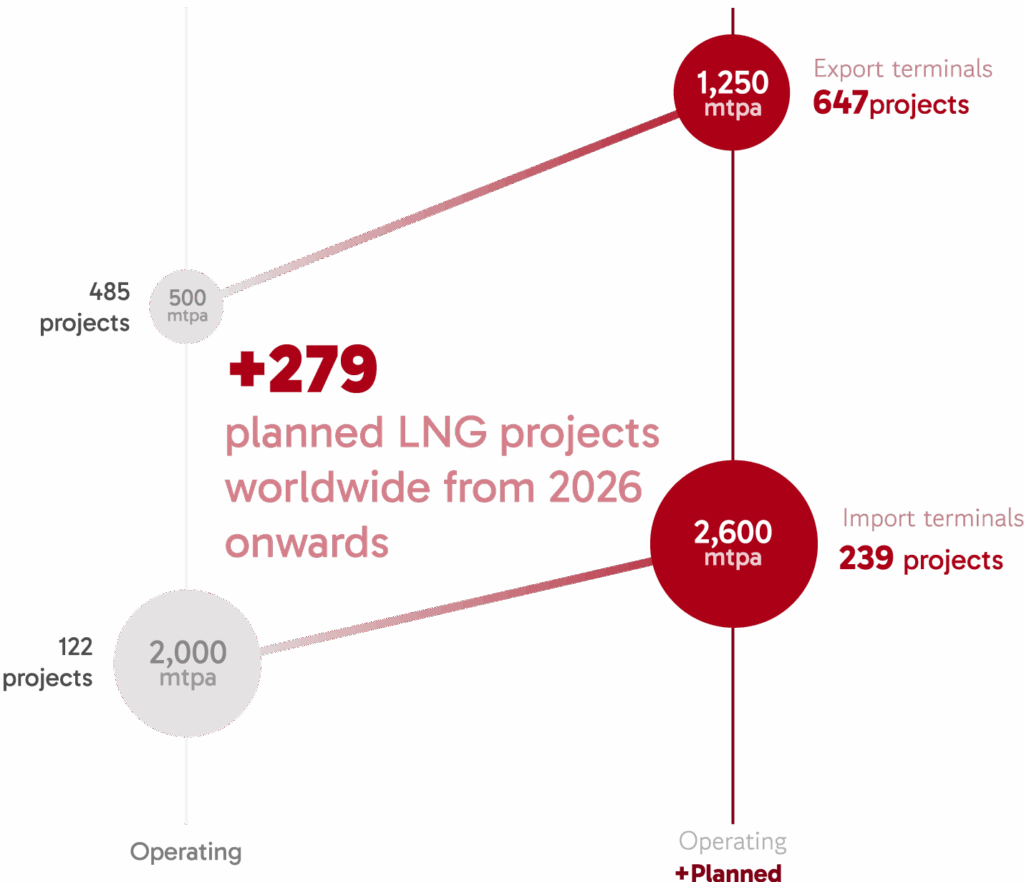

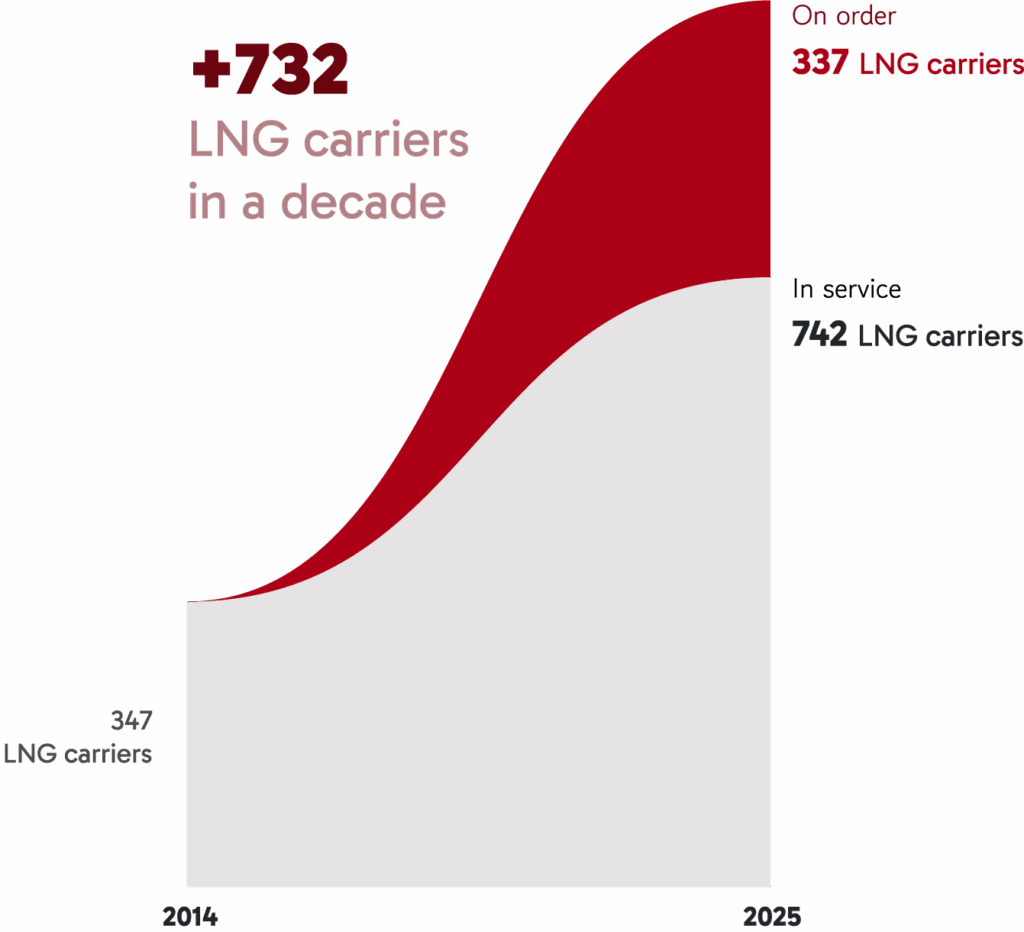

An unprecedented expansion

LNG has taken center stage in recent years. Following the Russian invasion of Ukraine in February 2022 and the subsequent spike in gas prices, it has been presented by the gas industry as a key solution to maintaining gas supply while ensuring energy security.

The LNG market is now poised for its largest wave of new supply by 2030. Global LNG supply is expected to expand by almost 50%, while global LNG carrier capacity is projected to grow by around 40%.

Source: Enerdata, Urgewald’s Global Oil and Gas Exit List 2024

Companies behind the LNG boom

Companies with the largest combined operating and planned capacity (in Mtpa)

150 companies

are responsible for more than 94% of planned export terminal capacities and more than 81% of planned import terminal capacities.

Capacity per company typology

Among the 150 largest LNG developers, several typologies of companies stand out:

- companies with upstream core activities, such as integrated companies

- midstream companies that include LNG specialized companies

- downstream companies that gather utilities and industrial companies

- financial institutions, such as private equity funds.

LNG brings climate, social, and economic risks

LNG expansion is incompatible with climate goals and a just energy future. The companies behind these projects and the financial institutions enabling them can stop these harms by retracting their involvement in all LNG expansion projects and ceasing all support to LNG expansion stakeholders.

Banks and insurers at the forefront of support

How banks fuel the LNG boom

Banks are key enablers of the global LNG boom. The 65 largest banks have funneled over US$174 billion into LNG expansion since 2021 — with 28 financial institutions increasing their support between 2023 and 2024 (see the methodology for more details. This massive wave of financing guarantees decades of additional greenhouse gas emissions and delays the necessary decline in fossil gas production and use.

The financing is concentrated among a handful of banks headquartered in OECD countries – mainly the United States, Japan, China, Canada, and Europe, in particular France – demonstrating the influence that a small number of major financial players can have on ending this expansion.

The role of insurers in LNG expansion

Insurers play a critical enabling role in the LNG industry: without insurance, LNG terminals and pipelines cannot be built or operated. This gives insurance companies significant leverage over fossil fuel expansion — like their proven impact on coal, where restrictive insurance policies have hindered coal mine operations.

We – NGOs fighting LNG expansion and communities affected by the LNG boom – call on banks to adopt comprehensive policies to end all financial services for new LNG projects, associated methane carriers, infrastructure, and LNG developers.

We call on insurers to stop providing coverage for new LNG export and import terminals.

We call on companies to immediately halt LNG expansion plans, which are having devastating impacts on communities, ecosystems, and the climate.