Companies leading LNG expansion

Companies behind

the import terminal expansion

About capacity

If these LNG projects are carried out, they will lead countries to a fossil fuel lock-in future. In the Asia Pacific region, several projects could hinder the energy transition by creating new reliance on LNG, such as in Bangladesh where LNG import terminals would multiply by five — if these go ahead, Bangladesh will rely on expensive LNG to supply new gas power even though investing in sustainable energy is cheaper.

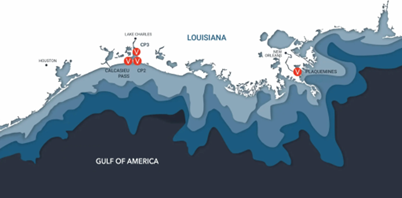

Where are planned LNG import capacities located?

Who are the companies behind this LNG terminal boom?

The 150 largest LNG developers can be categorized according to different typologies:

Beyond LNG terminals, some companies are assisting the LNG boom by providing the signatures needed on long-term contracts. These contracts are usually signed by integrated companies or utilities — without them, LNG terminals may not see the light of day due to being seen as higher risk.

For example, QatarEnergy’s LNG plans have been made possible with the 27 years-worth of LNG supply to Europe signed off by oil and gas majors such as Shell, TotalEnergies, and Eni, as well as Chinese companies such as Sinopec.

Learn more about

Companies behind

the LNG carrier boom

The global LNG carrier fleet has grown dramatically over the past decade with more than 330 new LNG carriers scheduled for delivery from 2026 to 2028 — the largest buildout in the industry’s history. In 2014, there were 347 LNG carriers worldwide. The fleet is expected to reach 1,079 vessels by 2030, including both operating ships and those already ordered. This is an increase of 732 ships — more than a 200% expansion since 2014.

This rapid expansion over a relatively short time reflects long-term investment in LNG supply chains and the growing role of LNG shipping in global energy trade. Indeed, to construct each large modern LNG carrier, close to US$200 million investment is needed. Once built, these carriers will operate for 30 years and even for up to 40 years in some cases.

The most striking finding is the dominance of South Korean shipyards: Hanwha Ocean, HD Hyundai, and Samsung Heavy Industries together have 231 LNG carriers on order, representing 68.5% of all new global orders. Future LNG carrier construction is thus highly concentrated in just a few shipyards, located overwhelmingly in South Korea. This concentration highlights:

- Where the majority of new LNG capacity will be built.

- Which shipyards — and their financiers — play the biggest role in expanding the LNG fleet.

- The scale at which new LNG carriers continue to enter the market.

We – NGOs fighting LNG expansion and communities affected by the LNG boom – call on banks to adopt comprehensive policies to end all financial services for new LNG projects, associated methane carriers, infrastructure, and LNG developers.

We call on insurers to stop providing coverage for new LNG export and import terminals.

We call on companies to immediately halt LNG expansion plans, which are having devastating impacts on communities, ecosystems, and the climate.