lng impacts

the economic and financial risks

The LNG market is set to experience its largest wave of additional supply through to 2030.

The surge in supply is driven by the massive expansion of LNG capacity in North America — particularly in the US.

According to industry projections, this additional supply will be absorbed primarily by developing and emerging markets, particularly in the Asia Pacific region. However, this expected rise in demand may never materialize — posing significant risks for companies and banks betting on the growth.

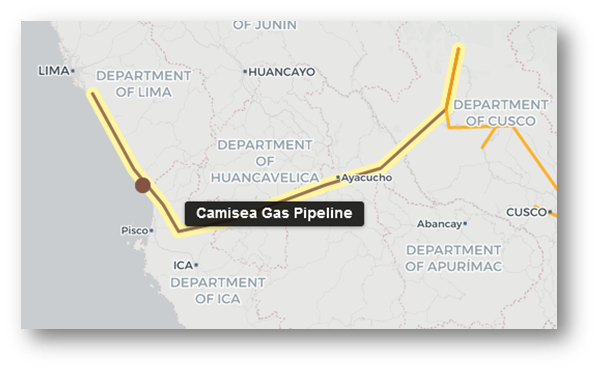

Case studies

We – NGOs fighting LNG expansion and communities affected by the LNG boom – call on banks to adopt comprehensive policies to end all financial services for new LNG projects, associated methane carriers, infrastructure, and LNG developers.

We call on insurers to stop providing coverage for new LNG export and import terminals.

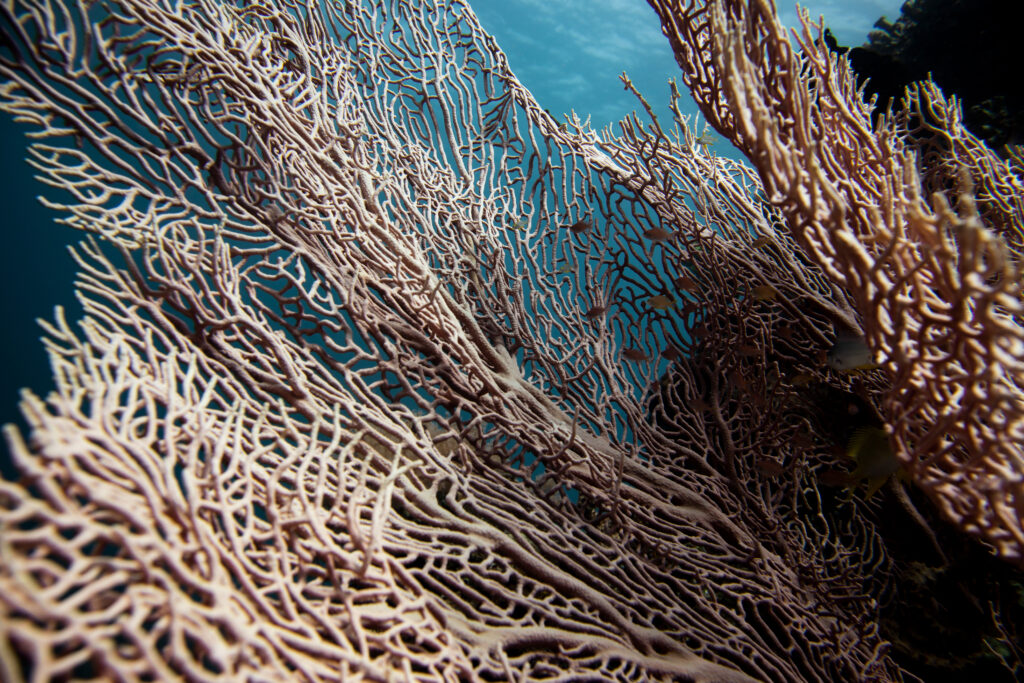

We call on companies to immediately halt LNG expansion plans, which are having devastating impacts on communities, ecosystems, and the climate.